Guide to Property Investing

Buying Property for Investment

If you want to buy a property and make money from it, you need to plan carefully. Buying a rental property is a big investment, so it’s important to get advice and make a good plan before you do anything. This will help you to get the best results!

Factors to consider when investing in property

Your current financial position

Do you have enough money to buy a rental property, even when it’s not rented out? It’s not just about how much you can borrow, but also about how much you can actually pay back. You can use a calculator to see how much you might have to pay each month.

Can you afford a good house?

If you want to invest in a property, it’s not enough that it’s cheap. You also need to think about whether it will attract good tenants and increase in value over time. To make sure your property is appealing to tenants, consider things like its location (close to transportation, stores, schools, and jobs).

Where are you heading?

Do you have enough money and are you willing to keep your investment for a long time? Or do you need the money back soon? Think about how your investment fits into your bigger money plan. Is your rental property going to be your home in the future or are you using it to buy more properties and grow your investment collection?

How much money will you need?

When you buy a property to make money, like renting it out to tenants, it can cost a lot of money at the beginning and you have to keep paying for repairs and maintenance. Knowing how much money you need to spend can help you make a good plan for your investment and make sure you can afford it.

How much can you afford to borrow?

To know how much money you can borrow to buy a property and where you can afford to buy it, you need to figure out your borrowing capacity first. This means understanding if you can afford to pay back the money you want to borrow. Before you start looking for properties to invest in, it’s important to know what you can afford. You can calculate this by looking at how much money you earn and how much you spend using our home loan quote, which only takes a few minutes.

Do you need a cash deposit?

If you own your home, you can use the value of your house to buy an investment property without needing to save up money for a deposit. You can then use the money you earn from renting out the investment property to pay off the loan.

How can property investors get the best home loan rates?

If you’re looking for a good interest rate for your home loan, it’s a good idea to compare different lenders. You might have a loan with one lender, but it’s important to shop around and not just take out another loan with them because it’s easy. Other lenders might offer a better interest rate and save you money in the long run. There can be a big difference in interest rates between different lenders.

When you’re comparing home loans, the interest rate is important, but there are also other things you should think about.

These include:

- any extra charges for borrowing money

- extra benefits the loan offer, like having a savings account linked to it or the ability to withdraw extra payments

When making important money decisions like this, it’s crucial to do your own research, compare different choices, and think about asking a professional for advice before making a decision.

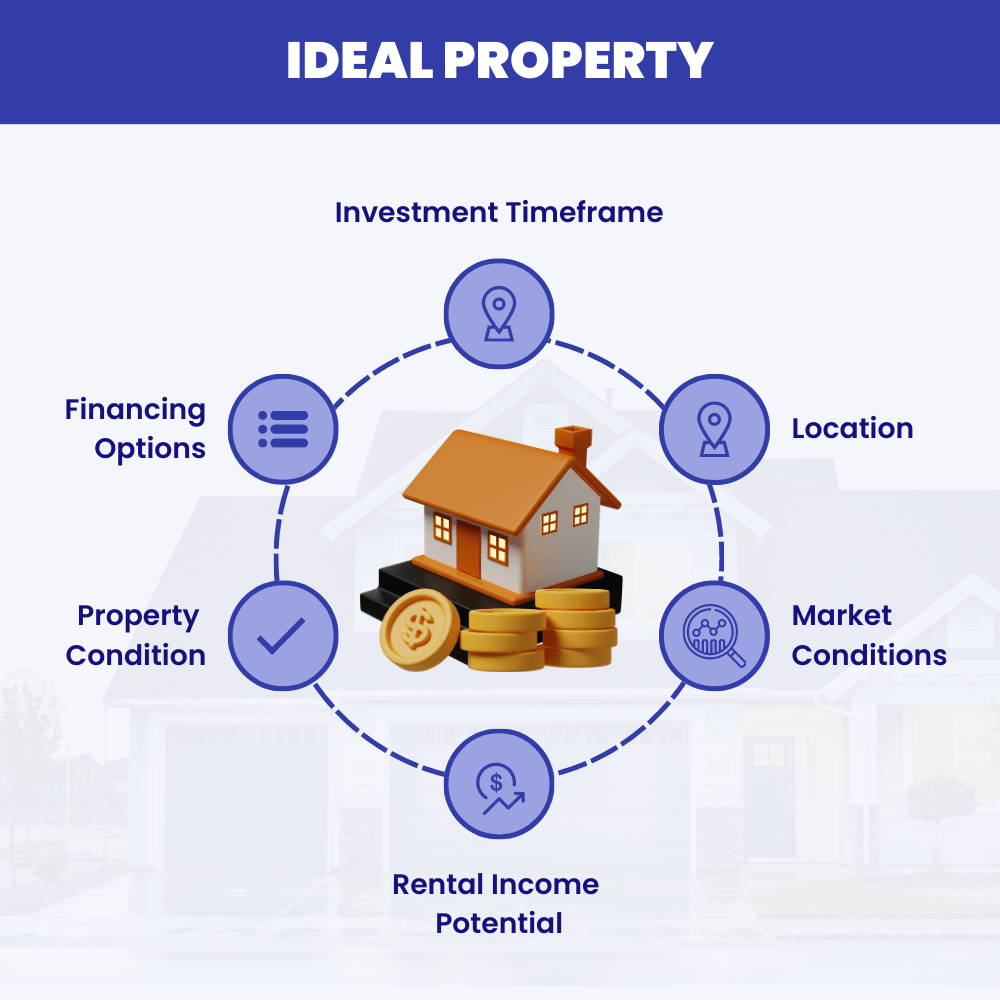

The ideal property

Here are some key considerations when evaluating a potential investment property:

A property located in a desirable neighborhood or growing area is generally considered a good investment. Look for areas with good schools, public transportation, amenities, and low crime rates.

A property that can generate high rental income relative to its purchase price and ongoing expenses is an attractive investment. Look for properties with features that tenants are willing to pay a premium for, such as updated kitchens and bathrooms, ample parking, or outdoor space.

Evaluate the local real estate market to determine if it is currently favorable for investing. Factors to consider include vacancy rates, price trends, and overall economic indicators.

Consider the current condition of the property and the potential for future renovations or repairs. Properties that need significant work may be available at a lower price but may require a larger initial investment.

Consider the financing options available to you, including mortgage rates and terms, down payment requirements, and the potential for leveraging your investment through financing.

Consider your investment timeframe and how it aligns with your financial goals. If you’re looking for a long-term investment, you may prioritize properties that have the potential for appreciation and value growth over time. If you’re looking for a short-term investment, you may prioritize properties that can generate quick rental income or have a higher potential for flipping. Additionally, you may consider how a potential property fits into your overall investment portfolio and whether it aligns with your risk tolerance and diversification goals.

Affordability

When you first become a landlord, it’s probable that you will spend more money on your property than you earn from renting it out. This is known as negative gearing. Although this might help you save on taxes, it’s important to make sure you can handle the expenses. Even excellent properties can go through times when they are vacant, so you should be prepared to make loan payments even when the property isn’t earning any money.

Tenant Appeal

To make money from renting out a property, you need to make sure it’s a place that good tenants would want to live in. Even if it’s cheap, if no one wants to live there, it won’t be a good investment. So, when you’re looking for a property to buy, ask yourself if you would want to live there. If you’re not sure, other people probably won’t want to live there either. You can learn more about how to find the right investment property by checking out our section on it. Once you know what you can afford and what you want, you can start buying properties to rent out and make money.

What are the ongoing and upfront costs of investing?

Before buying, it’s important to inspect the property for pests and building issues. This helps to prevent unexpected expenses for repairs or extermination later on.

If you want to buy a unit, apartment or townhouse, you should do a strata search. This search will help you find out if there are any problems in the building, such as arguments between people who live there, repairs that haven’t been paid for, or repairs that haven’t been done well. Doing a strata search is very important before you invest in one of these properties.

Stamp duty is a tax that you pay to the government of your state based on how much you paid for a property. It’s added to the value of your property, and when you sell it, it can lower the tax you might need to pay on the profit you make. To figure out how much you need to pay, you can use a stamp duty calculator.

Borrowing costs are expenses you need to pay when you borrow money from a lender. These expenses can include fees for applying for a loan, paying for an evaluation of the property you want to buy, and buying insurance for the lender in case you can’t repay the loan. This insurance is called Lenders Mortgage Insurance (LMI), and you only need to pay it if you borrow more than 80% of the property’s value.

Legal fees are expenses that you pay to a lawyer to transfer the property from the seller’s name to your name. This process is also called ‘conveyancing’ and is usually done by a solicitor.

When you own a property and rent it out to tenants, there are many expenses that you’ll have to pay regularly. These expenses can be reduced by claiming them as tax deductions (but it’s important to double-check with your accountant first). Check out our tax and gearing section to learn more about this.

Some of the regular expenses you may need to pay if you own a rental property are:

- Fees you pay to an accountant or tax agent for managing your taxes.

- Fees you pay to the body corporate for maintaining shared areas in a complex.

- The amount you pay to the council and water company for using their services.

- Insurance that protects you as a landlord against potential risks and damages.

- Legal fees that you pay for creating and updating lease agreements.

- A tax you pay to the government based on the value of your land.

- Advertising expenses you incur for finding new tenants or replacing old ones.

- The interest you pay on your loan if you borrowed money to buy the property. This interest rate can go up or down, so you should be prepared for fluctuations.

- Fees you pay to a real estate agent for managing your property and finding tenants for you. This fee is usually around 7% of your rental income.

- The cost of maintaining your property, such as cleaning, gardening, and repairs.

Are you thinking of moving up the property ladder?

If you want to move to a bigger or better property for any reason, such as needing more space for your growing family, wanting to live in a nicer area, or changing from an apartment to a house, you should consider the financial aspects carefully.

Consider the equity in your existing home

Your home equity is the difference between your home’s value and the amount you owe on your mortgage. You can use this equity as security instead of cash when purchasing your next home. As property values have increased in many parts of Australia, homeowners who have owned their home for a while may have accumulated a significant amount of equity.

Low stock drives capital gains

When there are not enough homes for sale, it can cause home prices to increase. This is happening now, but more homes are being listed for sale, which should help. However, demand for homes is still high, which means prices are likely to stay up. This is good news if you want to sell your home quickly and for a good price.

Buying before you sell

A bridging loan can be helpful if you want to buy a new house before selling your old one. It is a short-term loan that covers the mortgage on your current home and the expenses of buying a new one. However, it’s essential to consider the advantages and disadvantages since these loans usually come with higher interest rates.

Planning to invest?

You might be interested in these additional resources…

Do You Really Need a 20% Deposit?

Embarking on the path to homeownership, you might wonder about the significance of the deposit. Common wisdom suggests aiming for 20%, but with Lending Guide by your side, you’ll understand that this figure is a guideline, not a gatekeeper. Let’s explore the nuances of deposit size, the role of Lenders Mortgage Insurance (LMI), and how

Simplifying the Home Loan Process for Self-Employed Individuals

Hello, dedicated entrepreneurs, freelancers, and small business owners! We understand the tremendous effort you put into your work. However, when it comes to purchasing a home, being self-employed can sometimes feel like an obstacle rather than an achievement. That’s precisely why Lending Guide is here to assist you in connecting with the right mortgage brokers

Achieve Your Dream Home with Lending Guide – Your Trusted Partner for Residential Mortgage Brokerage

Purchasing a house is a monumental life-goal; we understand the significance it holds. It’s more than just a physical structure; it’s the canvas of your life, the repository of memories, and the sanctuary of warmth and security. At Lending Guide, we comprehend the pivotal role that securing the right home loan plays in transforming your